Why is money management and investing important for college students?

“ Nikhil was an ordinary school going boy, who wanted to do anything but make money. At the age of 14, he started his first business along with a friend which shut down within no time. He dropped out of school. Nikhil, at the age of 25 started a company which made him appear underForbes 30 under 30 receiving 100s of international awards.

Yes, he is none other than Nikhil Kamath, founder of a unicorn popularly known as Zerodha”.

The above example will evidently help you wonder, what exactly occurred. After his first unsuccessful business, Nikhil constructed an interest in the stock market and investment. He used to keenly analyze market trends and then invest the little amount he had. He initially earned decent profits. But, during the great depression of 2008, he suffered a major loss.

He never knew about giving up. He stepped up again, this time with better analysis, money management, and greater depths of understanding. Then, he received better tidings. The profits he earned were invested back by him and that’s how he established Zerodha – India’s Biggest Stock Broker Company.

Also Read | Effective Ways To Brand & Build Yourself On Instagram: DO’s and Don’ts

Why Invest?

Nowadays, you can make $1000 fast simply diversify your investments across many stocks and ETFs. When you’re looking for stocks to invest in, try to find those with high volume and liquid shares. Remember, in the stock market, there’s a loss with every profit! It is best to keep in mind that a day’s profit can be as high as 1000 if you do it right.

Almost every student receives fixed monthly pocket money from our parents. After our day-to-day expenditures, there is always at least 20% of it remaining with us. And when it comes to money, teenagers often have this notion, “Dad gives us the required money, everything’s sorted. Let us go shop at the mall”

Now regard the following lines:

A famous YouTuber named Ankur Warikoo says ” At the age of 20, if one starts investing a mere amount X per month (keeping the amount invested constantly), by the time he retires (age 60) , he will have Rs 1 Crore (as per today) i.e. approx Rs. 3.5 Crores by then. Are you wondering what X is?

It’s just Rs.2000. That’s the power of compounding.

Sounds irrelevant or misleading? Check the attached link for the detailed calculations.

Why in your 20s?

Understanding this will help you realize, how important it is, for each one of us, to know and understand our own money management, especially for those who are in their 20s.

The following are the greatest advantages of starting early:

- You have Tax-free money.

- You can dare to risk it.

- Right investment at the right time will give you an astonishing sequel. (Consider the example mentioned above)

Having understood this, here, we aren’t just talking in financial terms. Investment isn’t just the game of finances. One can also regard learning new skills as an investment. One might not realize it at this point, but these skills are undoubtedly the easiest investment that can yield the heftiest returns of all. Just, one should know how to monetize your skills, in a way that will yield an output within a certain period of time.

So If you are thinking of investing, START TODAY.

Are there any Prerequisites? Ans. NONE

Wish to pursue investing and earn? No DEGREE required.

Want to learn Money Management Skills? Well, this too No Degree!

What’s required then? Mere understanding, analytics, and most importantly, a pinch of courage.

But prior to commencing it, have a glance at the following things which are recommended to ensure.

Ensure you: 1) Don’t have any kind of Loan (if yes, consider repaying it first)

2) Have insurance (Life and Health insurance)

3) Have a time frame and a goal set.

Once you have checklist-ed the above points, you are all set !!

Some best books to learn investment:

| 1) Rich Dad Poor Dad | 2) One Up On Wall Street | 3) The Intelligent Investor |

| 4) The Little Book of Common Sense Investing | 5) The Psychology of Money | 6) The Simple Path to Wealth |

I recommend starting with “Rich Dad Poor Dad“, to get that money-making mindset.

Also Read | Goldman Sachs Interview: How to crack, Experience and Questions

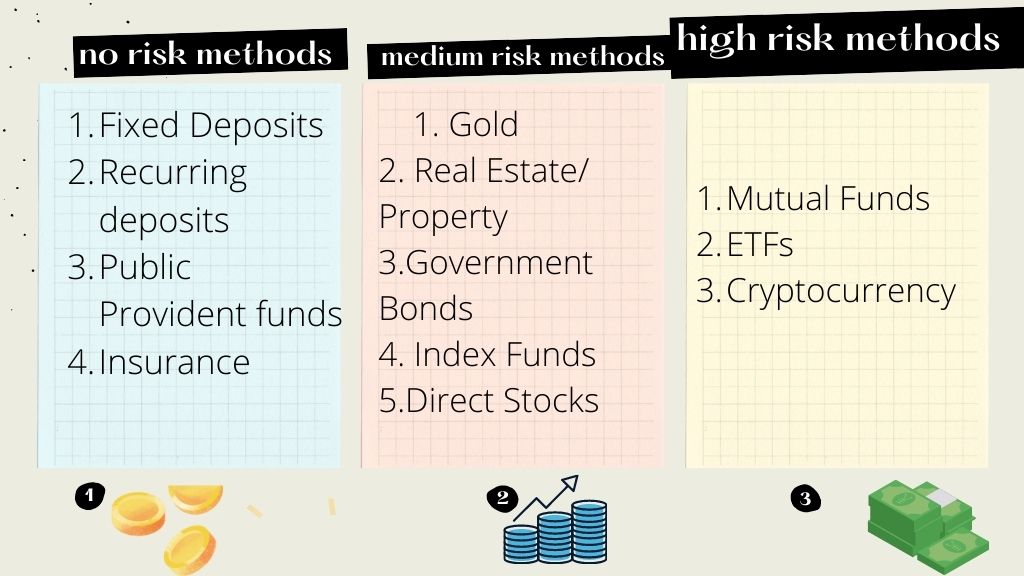

Where can you invest?

There is an ample variety of methods to invest your money. To overview the methods of investments and money management, have a look at the following chart:

How can beginners proceed with investment? 5 simple steps to follow

We all receive a certain fixed amount of money per month. It could be pocket money or money earned through an internship/part-time job or any other source.

Step1: Segregate the needs and wants.

For the amount of money, you receive per month, first sit down and segregate it into needs and wants. For students and people in their 20s, usually, the “needs” will approximately comprise 60% of it. Try minimizing the wants. Managing Money is the most important skill you should learn in your 20s.

E.g. Consider you receive Rs.1000 per month. You would still have Rs. 300 to save( after minimizing the wants). Instead of wasting it on fancy food/ luxuries which aren’t necessary, take a step down and appropriately invest the money.

Mark the words,

This will help you build your future.

Step 2: Analyze and form a portfolio :

On the basis of the amount you receive, duration of investment, and purpose, one must form his/her own portfolio.

A portfolio is nothing but an analyzed memorandum of how should one divide the amount to be invested within different portions.

A tip for benefit: A minimum of 20% of your monthly income should be invested.

Why do we analyze?

Here comes the most frequent question.

Considering the fluctuating conditions, and the risk factor involved, how can we take risks?

Ideally, for a beginner-investor, the portfolio should comprise:

30% direct equity stocks of great going companies (maybe pricey but ensure long-term returns), 40% portfolio stocks (mutual funds), 20% gold, and about 10% for cryptocurrency.

But remember!!! it’s your call and your analysis.

YOU ARE YOUR OWN DECISION-MAKER. You MUST FINALIZE IT FOR YOURSELF. NEVER LET ANYONE ELSE DO IT.

Step 3: Begin only when you get are instinctively ready

After analyzing and understanding trends, you will definitely find yourself in a position where an instinct will help you know when to start it practically. Wait for it to come.

Recommended | Top 5 Indian Podcasts in 2021 Every Youth Needs To Listen

Step 4: Create a demat account

The best lowest brokerage offered by any broker is Zerodha. Know more details on Zerodha Demat Account.

Step 5: Invest, start with a small amount

Even if you have funds, investing a large sum of money at once is not recommended. Consider dividing them into proportions as mentioned.

INVEST. HOLD. EARN. REPEAT

Step 6: Be patient and consistent:

Especially when it comes to high-risk methods. This is because they rapidly fluctuate and one cannot easily predict the outcome.

Still, one must know to hold on and have patience.

E.g. A novel investor commenced his investment in the month of Feb 2020. Little did he dream of the upcoming scenario of the COVID Pandemic. Once it hit the world, the market collapsed. The person was at a loss of almost 200 % of the principal amount he had invested. He was skeptical. But still decided to hold his shares. At the present date, the company recovered its losses and is in 100 % profit.

So, If you are into investing, Finances isn't the key, understanding is!!

To know more about this:

- One should begin by creating interest. You can try eyeing on web series like Scam 1992, Wolf of Wall Street, Rogue trader, etc.

- Recommended Books: The Intelligent Investor, The little book of Common sense of investing, The Essays by Warren Buffet.

- Also, precise and worthy content is provided by several Youtube creators like Ankur Warikoo, CA Rachana Ranade.

- To study the theoretical part of it through experts guidance, several free, as well as paid courses, are available these days various on platforms.

- Free Mobile Applications for practice: Zerodha Learning app

Thank you!

If you liked the blog do comment below. If you have any suggestions on how one can manage money, feel free to comment below, I will reply as soon as possible.

[crp]